Where a director is paid a monthly remuneration and he receives Directors Fees in a lump sum the MTD is calculated by using the Bonus Formula. Director SalaryBonus have to combo with KWSP which is good in a way that KWSP is tax exempted.

Taking Dividends Vs Salary What S Better Starling Bank

Superannuation must also be paid at a rate of.

. September 24 2021. Since you have secure your INCOME you need to start to have proper tax. Directors Remuneration and Tax Planning- Evidence from Malaysia.

Director need to issue Invoice to company for its Professional or consulting fees. The Royal Malaysian Customs Department RMCD released an updated service tax guide on professional services professional services guide dated 21 September 2021 which. Assuming the directors fees are being paid through an individual contractual arrangement ie.

The board is empowered again subject to the constitution to approve the fees of the directors and benefits payable to them including any. Saturday July 18 2009 Tax Treatment of Directors Fee and Bonus Referring to Section 25 2A of the Income Tax Act 1967 bonus and directors fee paid to employees or. Tax on directors fees.

See Terms of Use for more information. The directors receiving the directors fees are not taxed on them until they are actually received which will be the following financial year 2017 in this example. Tax Treatment Effective Year of Assessment 2016 4 6.

Statutory audit fees expenditure PUA 129 - Income. Generally if you pay a directors fee you are obliged to deduct tax at a flat 33. Thus subject to withholding tax on.

Income tax on directors sitting fees professional fees consulting fees applicable at 10. Insight - Directors remuneration. Given 1 Kena Tax Sdn Bhd Balance Sheet show.

Directors fees are normally. To meet this requirement a company must prepare the payroll for the directors fees and withhold PAYG tax from the gross amount. 22019 which explains the liabilities of a company director in respect of the companys tax.

So first estimate the tax relief you can claim take salary amount that gives. WHEN asked to respond on a maze of tax queries Albert Einstein whose theory of relativity is supposedly understood by only. Directors fees can be.

Accrued Directors Fees Tax Treatment Malaysia Jan 06 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd List Of Tax Deduction For Businesses. The director fees received by directors who are employees of the corporation at the same time are considered compensation income. Ive run a Sdn Bhd company since last year.

The tax must be withheld and paid to Inland Revenue while details of the gross payment the tax withheld and. Given 1 Kena Tax Sdn Bhd Balance Sheet show. In instances where the director receives.

The contract is with Mr Smith to act as a director not with Smith. The contract is with Mr Smith to act as a director not. Updated guidance addresses the taxation of professional services and specifically amounts paid to directors and office holders.

DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of. Accrual of director fee since 2018 RM100000 Accrual of director fee since 2019 RM150000 Accrual of director fee since 2020 RM200000. Also take director fee no additional tax relief to your company in form of employers KWSP portion.

Accrual of director fee since 2018 RM100000 Accrual of director fee since 2019 RM150000 Accrual of director fee since 2020. Tax on directors fees. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited DTTL its global network of member firms.

Assuming the directors fees are being paid through an individual contractual arrangement ie. On 14 March 2019 the Inland Revenue Board of Malaysia issued Public Ruling No. Payment of fees to directors.

How To Inform Mca Roc In Case Of The Death Of The Director

Accrued Directors Fees Success Tax Professionals

Required Documents For Incorporate Business In Singapore Incorporated Business Singapore Business

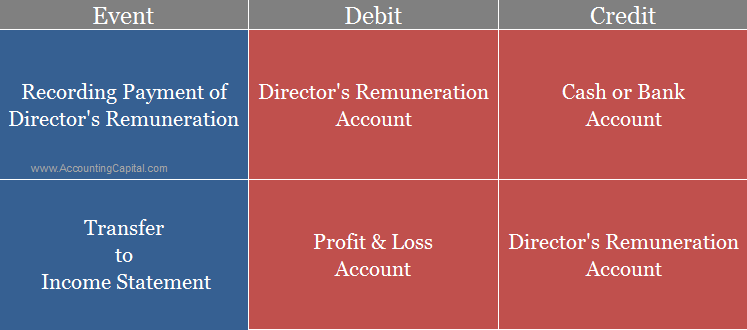

Journal Entry For Director S Remuneration Accountingcapital

What Is The Deemed Interest Income Taxable On A Director Loan From A Company

What Are Director S Withdrawals

Directors Fees Ato Everything You Need To Know Pop Business

Implications For Company Directors Of Personal Guarantees Crowe Ireland

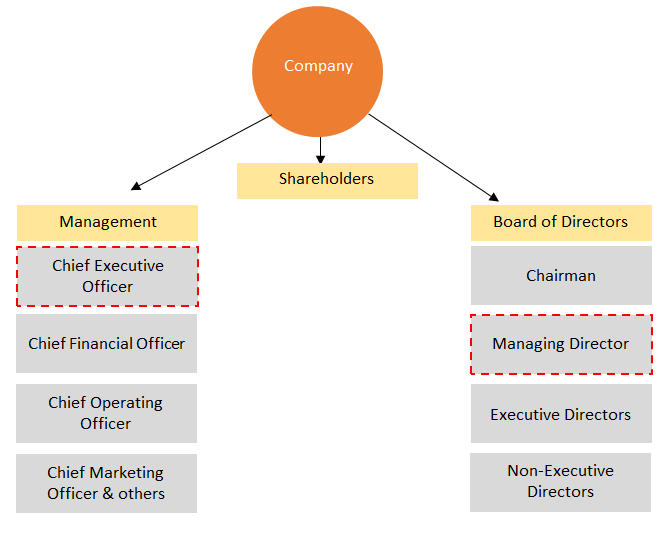

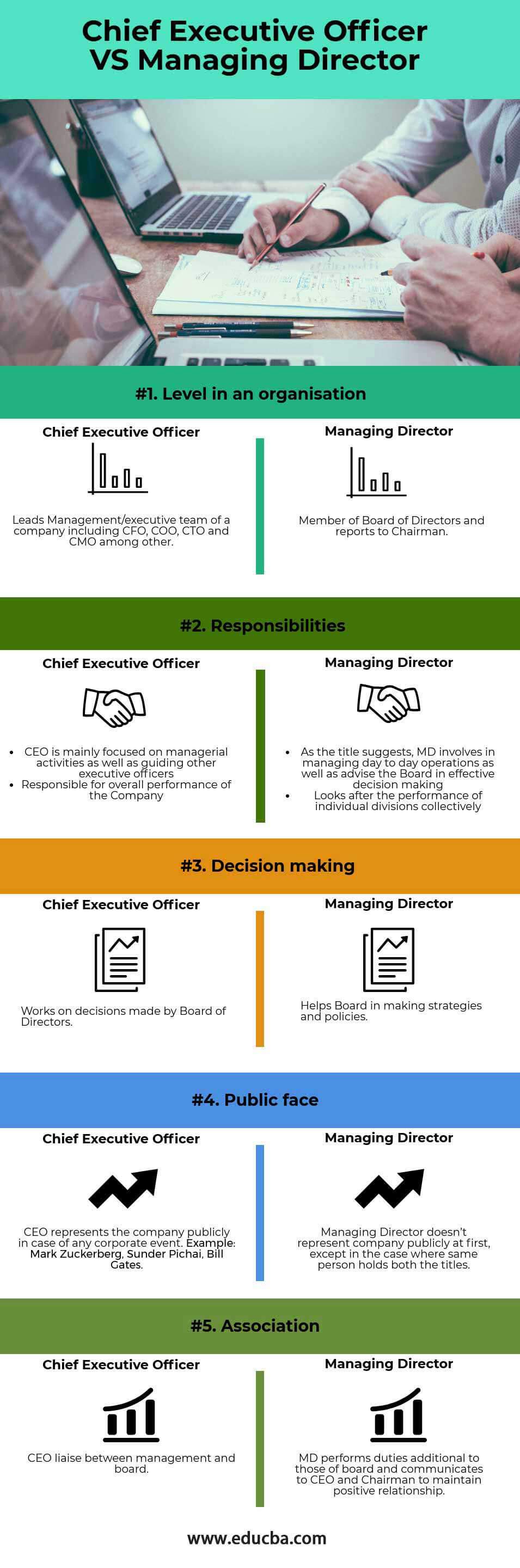

Chief Executive Officer Vs Managing Director Top 5 Differences To Learn

Are Shareholders Liable For Company Debts Company Debt

Can Directors Be Held Liable For Business Debts In A Limited Company

Recording Director S Expenses Correctly

Chief Executive Officer Vs Managing Director Top 5 Differences To Learn

Assistant Director Resume Examples And Templates That Got Jobs In 2022 Zippia

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Tax Planning For The Director Company Director S Salary Structure

Remuneration To Non Executive Directors Analysis Of Provisions Under Companies Act And Sebi Listing Regulations Scc Blog

Malaysia Taxation Of Professional Services Kpmg United States

11 Things You Need To Know About Dividends